Bringing Everyone to the Table: Bridging the finance-development divide

04 MARCH, 2025

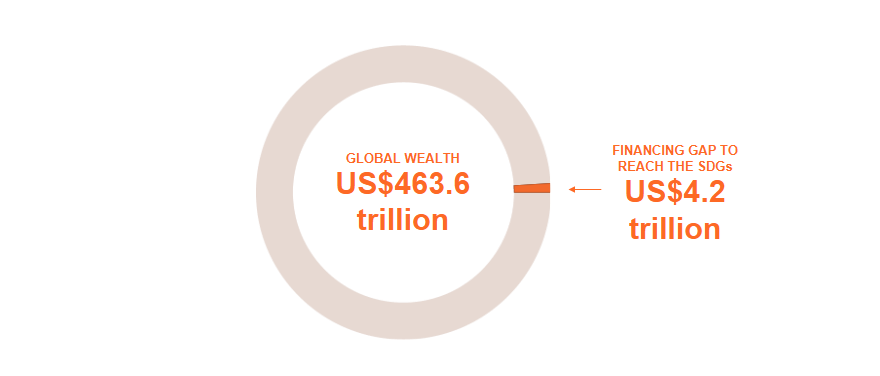

The world is at a critical juncture in financing sustainable development. With only 17 percent of the Sustainable Development Goals (SDG) targets on track and an annual financing gap of US$4.2 trillion, existing approaches are not delivering at the scale or speed required.

It is still possible to achieve the SDGs, but not without adequate financing. With global wealth surpassing $460 trillion, just 1 percent of that amount could provide enough financing to achieve all 17 SDGs.

Third Preparatory Committee Session for FfD4

In the lead up to Seville, the recent Third Preparatory Committee (PrepComm) Session in New York convened governments, development institutions, multilateral development banks, civil society, and private-sector partners. A clear message emerged: fragmented efforts are failing to deliver results, and development and finance partners must collaborate more closely to reform the global financial architecture so that the benefits of investment are shared with those who need them most.

The 12 UNDP-led PrepComm side events brought together a diverse range of stakeholders to advance new discussions on themes addressed in the FfD4 Zero Draft Outcome Document. such as Integrated National Financing Frameworks (INFFs), climate and nature finance, de-risking mechanisms, tax cooperation, gender equality, financial resilience, and inclusive public-private collaboration.

These side events included:

- Advancing sustainable bond markets through strategic partnerships in Latin America and the Caribbean

- Developing a playbook: Actions for collaboration between finance and development institutions

- Equanomics – Public finance for gender equality

- From fragility to crisis to resilience and development through sustainable finance

- Debt instruments and human rights: Innovative financing to end modern slavery and human trafficking

- Public finance for the SDGs: Taking forward the dialogue

- Tax Inspectors Without Borders: From the Addis Ababa Action Agenda to FfD4 – Strengthening tax cooperation for the 2030 Agenda

- Future-proofing development: The absence of financial resilience in a world of rising risks

- Triangulating climate, nature and development through integrated finance

- Aligning private business and finance with the SDGs: The role of ISO/UNDP standards

- Finance for all: Solutions from local and regional governments

- INFFs and country platforms: Strengthening the alignment between investment plans and policy frameworks

With a combined participation of over 600 attendees, the discussions generated concrete recommendations on initiatives and approaches for:

- aligning national financing strategies with SDG commitments;

- strengthening country-driven approaches;

- enhancing cooperation on tax and financial regulation;

- expanding innovative financial instruments; and

- mobilizing capital for long-term resilience.

The Road Ahead: A Call to Action towards Seville and Beyond

This kind of collaboration among finance and development institutions must become the norm, not the exception. Businesses and investors also have a crucial role to play, but they need to connect with governments and multilateral organizations to establish the right enabling environment, risk-sharing mechanisms, and incentives to secure social and environmental – as well as financial – returns on investment.

UNDP is committed to bringing these partners closer together. The Fourth PrepComm Session on 30 April and 1 May will advance these discussions and forge new partnerships that pave the way for financing for the SGDs, climate and biodiversity targets.

In line with UNDP’s ambition to promote the investment of $1 trillion in public and private financing towards these goals, we are working more broadly to ensure that the benefits of investment are distributed more equitably and sustainably.