Africa’s Climate Leadership: from Financing Commitments to Capital

16 DECEMBER, 2025

African leaders convene in Addis Ababa to shape a continent-led climate and finance agenda at the Second Africa Climate Summit, 8 September 2025.

The Road Ahead: from Addis to Belem and beyond

“Invest in Africa. Not because we are victims, but because we offer opportunity”[1]

A politically assertive African leadership engaged with world leaders at the recently concluded 2025 United Nations Climate Conference (COP30) in Belem, Brazil. This pivot, from aid dependency towards Africa as a dynamic source of investment opportunities for green growth and climate-resilient development, stemmed from the second Africa Climate Summit (ACS2) in Addis Ababa September 2025, where African nations stood united in the need for more climate finance, while continuing to leverage its own capital to address climate change. At the same time, both Ethiopia’s Prime Minister Abiy Ahmed and Kenya’s President William Ruto underscored that while Africa is not the cause of the climate crisis, its countries are among the most severely affected and as such must play a leading role in addressing it, positioning the continent as a provider of solutions, not as a victim.

The message was clear — Africa is not waiting, nor does it need to be rescued. Rather, it is positioning itself as a leader in the global climate order, reframing climate finance as an investment, or asset, class rather than a hand-out.

The continent is rife with areas of investment opportunities to meet national and regional climate and development objectives. The key is to focus not just on where the capital will come from but also how to make existing money work smarter.

The imbalances: financing equations are not adding up[i]

Several imbalances need to be corrected to finance effective climate action on the continent. First, global allocations are skewed, with Africa receiving only a fraction of global climate finance (3-4 percent). African countries require 4-5 times more to finance their Nationally Determined Contributions (NDCs), with estimates ranging from US$143 to $277 billion annually. Second, most climate financing goes towards mitigation, with only 36 percent focused on adaptation even though most African nations need to adjust to the impacts of climate change. Third, private financing comprises only 18 percent of overall climate financing on the continent. As a result, countries are not yet fully leveraging the potential of private capital. Finally, there is an over-reliance on traditional grant-based approaches which limits the level of financing that can be accessed.

Re-Balancing the equation

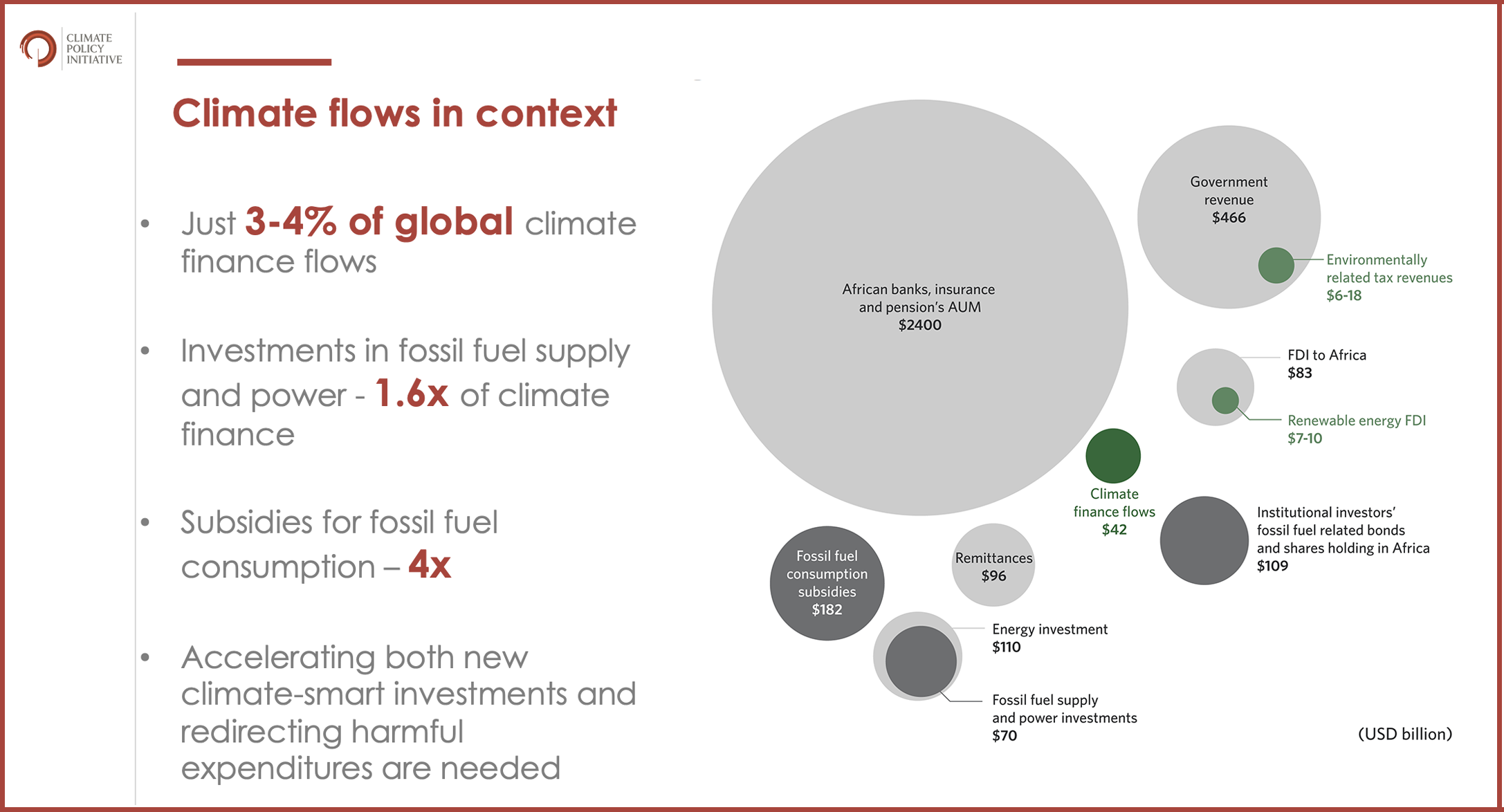

Global climate action faces a funding shortfall of trillions of dollars. But what if the money was already on the table, just under a different name? Zooming out from climate financing, one can see how development finance can contribute to climate action through a much larger pool of African-led mechanisms (see diagram below). For instance, diaspora financing flows are double that of climate finance while government revenues lack coherence in addressing climate action across public financial management systems. The real prize lies somewhere within Assets Under Management (AUM) by African financing institutions, which far outweigh any financing flows available across the continent.

Graphic credit: Climate Policy Initiative, Africa Climate Week 2025

Three key strategic bets are needed for countries across the continent, with some already making their move.

- Investment-ready NDCs. NDCs lay out the key priorities for climate initiatives but need to further connect with the investment community. Two key entry-points are emerging. First, countries are developing adjunct climate financing strategies (South Africa) and investment plans (Angola) which are converting NDC aspirations into bankable initiatives for attracting public and private capital. Second, some countries are going beyond NDCs by integrating climate into their Integrated National Financing Frameworks (INFFs) (Sao Tome and Principe, Ethiopia, Lesotho, Mauritania and Kenya). This helps countries look outside traditional climate finance to a larger ecosystem of investment opportunities.

- Structure the right instruments. Several financing instruments are being applied to leverage further investment across the continent, allowing countries to ease reliance on ODA and traditional grant-based climate finance. First, remittance flows are being leveraged for community development through diaspora bonds (Lesotho, Nigeria) and crowd sourcing platforms (Ghana), with a strong focus on climate action. Second, national development banks and pension funds are developing financing facilities and climate-related pipelines to finance climate action (Development Bank of Rwanda, County Pension Fund of Kenya). Finally, governments’ own public revenues are being more closely aligned to their climate ambition (climate budget tagging in Ghana and Ethiopia; county level financing in Kenya).

- Bankable pipeline and investment brokering. Many regional and global investors are willing to invest in Africa’s plethora of opportunities but need a stronger pipeline of projects that offer clear rates of return and climate-positive impacts. Some promising examples are already emerging. UNDP’s INFF’s Facility (INFF-F) and Platform for Investment Support and Technical Assistance (PISTA) are working with Ghana, Kenya, Congo, Senegal, Mauritania and Malawi to identify and structure climate projects that can attract large-scale investment. By strengthening their investment readiness and linking them with pension funds, diaspora finance and impact investors, private capital is directly channelled into projects that advance NDC targets on adaptation and mitigation. Ethiopia and Tanzania are adapting country investment platforms to link willing investors to these pipelines, and youth-led startups are nurturing a new generation of climate entrepreneurs through UNDP’s timbuktoo and Youth4Climate initiatives.

Africa is no longer just asking for climate finance. It is designing systems to attract it. African countries are transforming their own public and private capital, while international flows transition from plugging the gap to complementing local ingenuity.

[1] President Taye Atske Selassie of the Federal Democratic Republic of Ethiopia (at the opening of the Africa Climate Summit 8 September 2025)

[i] All figures sourced from CPI-Climate Policy Initiative